- The October 2025 internet outage exposed the vulnerability of a fully digital financial system.

- Both CBDCs and stablecoins pose risks to privacy, government control, and financial stability.

- Physical gold offers a safe, tangible way to protect your wealth from digital and systemic risks.

A Digital Wake-Up Call

In October 2025, a massive internet server outage caused widespread disruption across the United States. Financial markets froze, digital transactions stalled, and businesses struggled to process payments. For a system that increasingly relies on digital infrastructure, the outage was a stark reminder of how vulnerable our economy has become to technological failures. It also serves as a wake-up call: the digital economy may be off most people’s radar, but the risks it poses are real and growing.

Legislative Tug-of-War: GENIUS Act vs. Anti-CBDC Law

In July, 2025, Congress passed seemingly opposing pieces of legislation. They supported the development of the crypto currencies known as stablecoins with the GENIUS Act. The law requires stablecoins be fully backed by highly liquid, low-risk assets such as U.S. dollars and short-term Treasuries. It also imposes strict compliance and disclosure rules. These rules aim to boost stability, transparency, and consumer protection in the stablecoin market while also encouraging innovation and growth.

At the same time, Congress passed the Anti-CBDC Surveillance State Act. It prohibits the Federal Reserve from issuing a public-facing central bank digital currency, or CBDC. This decision reflects concerns about government overreach, financial surveillance, and privacy risks.

Continued Development

Despite President Trump’s freeze on a formal digital dollar, research and development continue. The Federal Reserve has partnered with major banks including JPMorgan, Bank of America, and Citibank on a digital dollar pilot program called the Regulated Liability Network. This program tests blockchain-based solutions for tokenized digital dollars. Its goal is to enable real-time settlements, cross-border payments, and greater financial inclusion.

Understanding CBDCs

What exactly is a CBDC? A central bank digital currency is a government-issued digital version of the U.S. dollar that would be available to the public and fully backed by the Federal Reserve. Unlike money held in commercial bank accounts, which is a liability of private banks, a CBDC would be a liability of the central bank. Advocates say it could speed up monetary policy, improve cross-border payments, and provide safer, faster digital payment options. In theory, during a crisis, the Federal Reserve could instantly adjust interest rates on CBDC holdings to stimulate spending or stabilize the economy.

The Risks of CBDCs

Yet the very features that make CBDCs appealing also create serious risks. The central bank would have direct control over individual accounts, raising concerns about privacy and government surveillance. Your money could be tracked, and policies such as negative interest rates could be applied automatically.

The U.S. may have hit pause on a public CBDC, but global pilots keep advancing. In China, the digital yuan has already logged over ¥7 trillion (about US$986 billion) in transactions. Like it or not, U.S. adoption now seems inevitable, driven by fears of being locked out of the new global digital economy.1

Stablecoins: A Private Path to Digital Dollars

Meanwhile, stablecoin adoption has been parabolic. In 2025, the total market capitalization of stablecoins exceeded $300 billion dollars. It increased by nearly $100 billion in just the first nine months of this year alone. But what actually are they?2

3

Stablecoins represent a private-sector path to the same digital currency destination. Unlike CBDCs, stablecoins are issued by private companies or decentralized financial platforms. They are designed to maintain a stable value, typically pegged one-to-one to the U.S. dollar.

Though privately issued, they remain subject to government oversight. Issuers could be forced to share data or alter operations, making them, in effect, a private version of the digital dollar with similar risks to privacy and financial freedom.

Jeremy Kranz, is the founder of the venture capital firm Sentinel Global. He noted that privately issued stablecoins possess surveillance, backdoors, programmability, and controls akin to CBDCs. He showed how issuers like JP Morgan can freeze assets and restrict access under certain regulations, such as the Patriot Act.

Kranz said that issuers of overcollateralized stablecoins could face a “bank run” if too many users tried to redeem their tokens at once.4

Conclusion

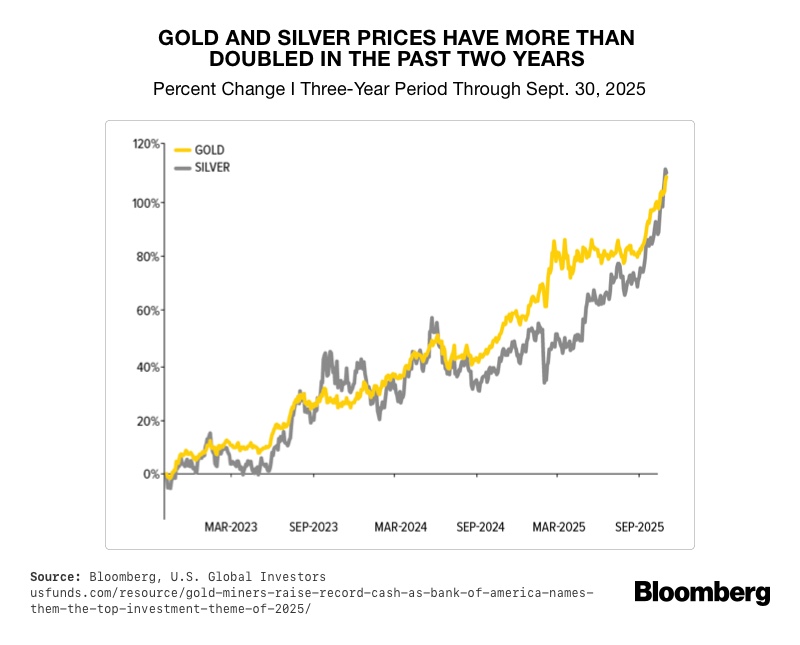

Ensuring the security of your wealth requires a strategy that includes assets outside the digital realm. Physical gold offers a tangible, unhackable alternative. Gold cannot be erased by a server outage, altered by government policy, or devalued through digital manipulation.

For Americans concerned about preserving wealth in an increasingly digital financial system, gold provides stability, privacy, and protection from systemic risk. A Gold IRA allows investors to safeguard retirement savings with physical, allocated gold while potentially benefiting from long-term appreciation. To learn how to protect your savings with a Gold IRA, contact American Hartford Gold today at 800-462-0071.