- Some analysts see record setting stock prices as a prelude to a bursting bubble, with prices dropping as much as 65%

- Recessionary forces could knock the support out from overvalued stocks

- Americans can prepare for the stock crash by moving into safe haven assets like physical gold & silver in a Gold IRA

Looming Stock Market Crash

To some analysts, record-setting stock prices don’t seem to be climbing to new heights but rather racing towards the edge of a cliff. Facing potential overvaluation and recession, stock prices have been predicted to crash as much as 65%. Americans are cautioned not to let over-optimism and fear-of-missing-out prevent them from protecting their assets from a major market correction.

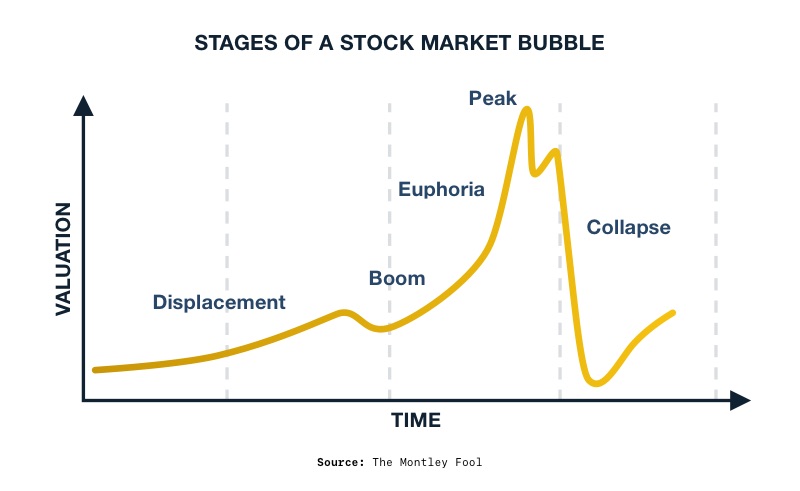

The warnings of an impending crash are coming from several sources. John Higgins of Capital Economics says stocks are in a late-stage bubble. That means stocks are in for a steep rally before the bubble bursts. He points to the S&P 500 and DJIA hitting record highs recently. “Bubbles tend to inflate the most in their final stages as the excitement sort of reaches fever-pitch,” Higgins warned.1

Higgins says that today’s hype around AI resembles the dot com bubble of the 90s. When that bubble burst, the Nasdaq lost 77% peak-to-trough in the early 2000s. The overall market saw $5 trillion in value wiped out in a couple of years. According to Capital Economics, the bubble could burst as soon as the end of next year. That would be five years, the length of the dot-com bubble. 2

3

3

Warnings from Wall Street

Some Wall Street veterans are taking a bearish view of the current stock market rally.

Gary Shilling is an American financial analyst and commentator who appears regularly in publications such as Forbes, The New York Times, and The Wall Street Journal. He correctly identified the US housing bubble in the mid-2000s. Shilling expects a recession to hit by the end of the year. He thinks a weakening labor market will crush investor confidence. As a result, the stock market could fall as much as 30%. “You look at all the kind of speculation that we’ve had out there, it’s indicative of a lot of overconfidence, and that usually gets corrected and corrected violently,” said Shilling.4

John Hussman is the president of Hussman Investment Trust. He correctly predicted the sharp downturns in 2000 and 2008. He thinks the S&P 500 is trading at similar extremes last seen in the run-up to the 1929 Great Depression. Hussman thinks the S&P could crash 65% based on a combination of “extreme valuations, unfavorable market internals, and dozens of other factors.” A loss that size would wipe out a decade of gains.5

BCA Research strategist Roukaya Ibrahim warned that a 30% correction in the stock market could be sparked by a recession early next year. He thinks overvalued stock prices and slowing growth will send the S&P back down to 3600. Ibrahim points to the April employment report which signaled an economy in decline. “Eventually, the unemployment rate is going to take higher and that’s going to lead to concerns about a recession,” Ibrahim said.6

Market Indicators

One indicator going off is the ‘Hindenburg Omen’. It has predicted two previous stock market crashes. The ‘Hindenburg Omen’ indicator considers the percentage of stocks in an exchange making 52-week highs and lows, along with other market breadth metrics, to assess the potential for a market crash.

The indicator successfully predicted the 1987 market crash and the 2008 financial crisis. And it is sounding the alarm again. Now it is going off despite record market highs. Poor market breadth is the cause for concern. Only a handful of stocks are buoying the whole market.

Other signs are showing that the economy is heading towards recession. A recession could crater stock prices.

Top economist David Rosenberg points to the Sahm Rule. Rosenberg famously predicted the 2008 recession. The Sahm Rule is a way to identify the start of a recession using the unemployment rate. It signals a recession if the three-month average unemployment rate rises by 0.5 percentage points or more above its lowest point in the previous 12 months. The rule is about to go into effect. Unemployment ticked higher than 3.9% in April. In addition, manufacturing shrank for the 17th month out of the last 18 months.

The Fed’s “higher for longer” interest rates are also pushing the economy towards a hard landing. Albert Edwards, the Societe Generale strategist, said, “”I believe the Fed is sowing the seeds of yet another policy disaster.” He maintains that decades of near zero interest rates fueled speculative bubbles that kept “bursting in their faces.” And now, he thinks, suddenly high interest rates are going to burst the AI bubble. 7

Conclusion

While it may seem that record setting stock prices may never end, forecasters are warning to brace for a crash. The meteoric rise will inevitably fall. The question is how hard and how fast. According to some analysts, everything will be great until it isn’t. Then prices could drop 65%, devastating retirement funds. Now is the time to prepare for a market drop by learning how a Gold IRA can protect the value of your funds. Contact American Hartford Gold today at 800-462-0071 to learn more.

Notes:

1. https://markets.businessinsider.com/news/stocks/stock-market-crash-prediction-dot-com-bubble-correction-economy-recession-2024-5

2. https://markets.businessinsider.com/news/stocks/stock-market-crash-prediction-dot-com-bubble-correction-economy-recession-2024-5

3. https://m.foolcdn.com/media/dubs/images/stock-market-bubble-infographic.width-880.png

4. https://markets.businessinsider.com/news/stocks/stock-market-crash-predictions-recession-soon-inflation-corporate-profits-decline-2024-5?utm_medium=ingest&utm_source=markets

5. https://markets.businessinsider.com/news/stocks/stock-market-crash-predictions-recession-soon-inflation-corporate-profits-decline-2024-5?utm_medium=ingest&utm_source=markets

6. https://markets.businessinsider.com/news/stocks/stock-market-crash-predictions-recession-soon-inflation-corporate-profits-decline-2024-5?utm_medium=ingest&utm_source=markets

7. https://www.businessinsider.com/stock-market-crash-recession-warning-signs-interest-rates-fed-edwards-2024-5?utm_medium=ingest&utm_source=markets&_gl=1*1eqjxbf*_ga*MjEyNjU3MzkyMi4xNjYyNDEwODU4*_ga_E21CV80ZCZ*MTcxNjk5ODIzOC4xNDkuMS4xNzE2OTk4MzEwLjU5LjAuMA

4

4

1

1