Consensus has it: this week’s Federal Open Market Committee (FOMC) meeting will be ushering in another 25-basis-point rate hike for the U.S. At this point, this is no surprise. But some gold watchers think there could be an opportunity here with gold prices.

China Vows to Replace U.S. Dollar

Many currency experts believe that China, a rising currency powerhouse, could soon take the dollar’s long-held place as the world’s most desirable currency.

Federal Reserve Under Fire: What Insiders are Saying

The U.S. economy continues to battle storm clouds on every side. Experts were caught off guard last week when a particularly bad data report hit the wires, sending gold prices up for a fourth week in a row. Not surprisingly, the news was about employment. U.S. job growth in May landed well below expectations with … Read more

Could the U.S. Seize Your IRA? Fact and Fiction

Far-fetched or not? Some experts believe the U.S. could confiscate IRA assets (now totaling over $7.8 trillion!) and force everyone into a collective government retirement plan.

TD Waterhouse Predicts That Gold Will Move Higher

Short term trends have been favorable to gold in May, with bullion currently near its one-month price peak. TD Waterhouse research says the main drivers include an unexpectedly dovish Fed, a weaker U.S. dollar and rising political uncertainty. “Given the current political circumstances and emerging uncertainty surrounding US rate hikes and broader monetary and fiscal … Read more

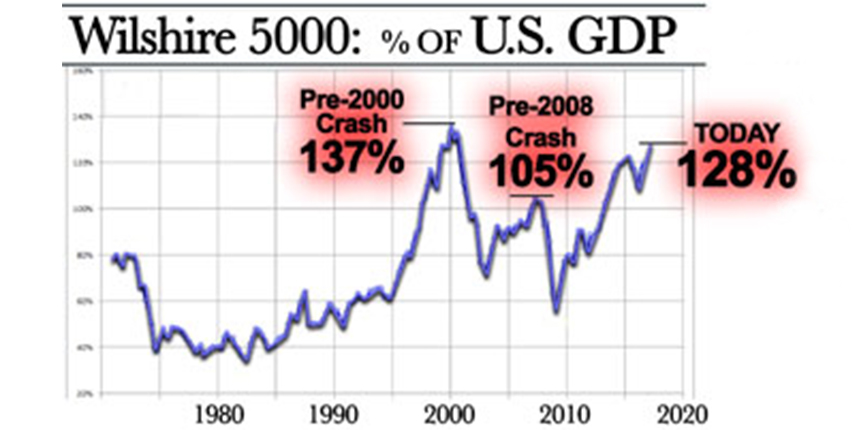

Warren Buffett’s “Buffet Indicator” Chart: What it says for 2017

Legendary investor Warren Buffett relies on one simple rule to know when stocks are too hot. In pro investing circles, it is known as the “Buffett Indicator.” Buffett himself calls it “the best single measure of where valuations stand at any given moment.” What is the magic indicator? The ratio of total stock market capitalization … Read more

Cyberattack WannaCry Virus: Target America

Over the last few days, America has been rocked by the largest cyberattack the world has ever seen: the so-called “WannaCry” virus.

U.S. Stock Market Bubble: Ready to Burst?

Stocks are trading at nosebleed levels, interest rates are on the rise and signs of a housing bubble abound. This is a perfect time to consider physical gold and silver as the insurance policy you need to weather the coming turbulence. 2017 marks the eighth anniversary of the second longest bull market in history. If … Read more

Expert Warns: Market Bubble Has Reached “Complete Insanity”

Former Reagan administration Office of Management and Budget Director David Stockman thinks today’s stock market has reached the point where greed has overtaken logic.

Will Gold History Repeat Itself?

Summer is just around the corner, but is it really 2017… or more like 1977?

China Gold Rush? Imports Up 65% on Safe Haven Demand

America isn’t the only country where investors are turning to safe haven assets in the face of shaky local and global economic conditions. Chinese investors just sent gold imports soaring by 65% on an annual basis in the first quarter of 2017. Why? The China Gold Association’s official statement said the reason was “increased public … Read more

Goldman Sachs: Correction Chances High for 2017

Goldman Sachs’ chief global equities strategist Peter Oppenheimer has cautioned that overzealous investors have “overpriced the ability of the administration to push through some of the things the market is priced for.” He says that a chance of a “correction,” normally defined as a drop of at least 10%, is “quite high.”

This is just one reason why demand for physical gold and silver has been so sustained. In fact, gold hit a new high for 2017 just last week.