- The IMF warned that the unprecedented US debt is a danger to the global economy

- Debt-fueled high interest rates in the US have severe negative consequences for developing nations

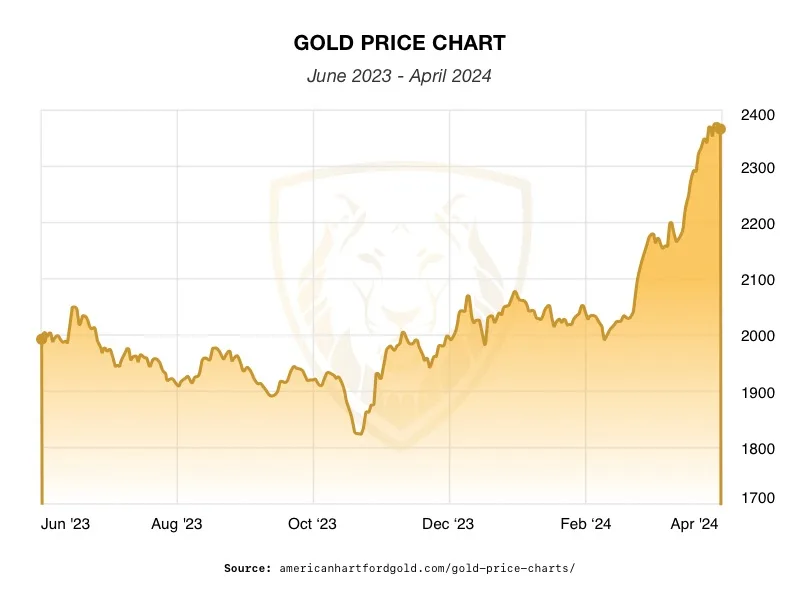

- Facing global economic repercussions, many Americans are turning to safe haven physical gold and silver to protect their wealth

IMF Warns About US Debt Danger

The International Monetary Fund has warned that the US national debt poses a significant risk to the global economy. Our massive government spending is overheating the economy, reigniting inflation, and raising global funding costs. The ramifications of which will cause instability and damage the economic security of those here and abroad.

The IMF pointed out that some countries are taking measures to reduce debt. The US is not among them. Instead, they said the US is one of four countries that needs to critically address the fundamental imbalance between spending and revenue. The others are China, Italy, and the UK. The US is expected to record a fiscal deficit that is more than triple the level of other advanced economies.

The rate at which the US is acquiring debt is accelerating. Or as the IMF put it, there were “large fiscal slippages” during 2023. Government spending exceeded revenue by 8.8% of GDP. That is more than double amount in 2022. 1

That rate isn’t going to slow, especially with many elections this year, including a Presidential one. Public spending is likely to increase as leaders try to build support.

2

2

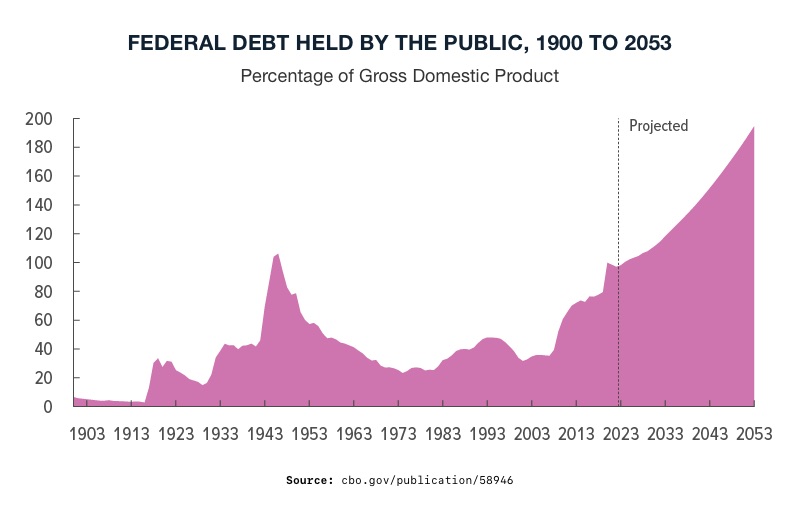

Here is a glimpse of the US Debt by the numbers:

2023 Government debt is 122% of annual GDP3

2024 US debt breaks $34 trillion on its way to $35 trillion

2029 Government debt projected to rise to 133.9% of annual GDP

2034 National debt projected to hit astonishing $54 trillion

2053 Government debt projected to rise to over 200% of annual GDP4

2053 US public debt estimated to be $70 trillion

Servicing and Selling the Debt

The cost to service the debt doubled from 2020 to 2023 to $659 billion a year. The government is spending more to service the debt than it does on housing, transport, and higher education. 5

The government is planning on selling another $386 billion of bonds in May. They are likely to continue selling debt at that pace throughout the year. Yet, markets are struggling to absorb all the new debt being issued. The reluctance comes from inflation worries, uncertain monetary policy, and the size of the debt. Risk premium, meaning how risky US debt looks, is growing.

To make the bonds more attractive, investors demand higher returns to hold US Treasuries.

The increased interest makes the debt more expensive. Rising rates in the US lead to matching rises in developing economies. Bond’s vulnerability to inflation and high interest rates is increasing financial instability. The IMF said that “This could lead to volatile financing conditions in other economies.”6

Even if the Fed cuts rates this year, US government funding costs may not fall by the same margin. The high cost of servicing the debt leaves less money for public services or dealing with emergencies like financial meltdowns, pandemics, or war.

Impact of Debt on the US

The resulting high interest rates needed to fund the debt seep through our economy. High interest rates make loans more expensive for businesses and individuals. This slows growth and depresses stock prices. In addition, high rates lead to more defaults, putting more stress on an already fragile banking system.

Fed Chair Powell signaled that rates could stay higher-for-longer due to inflation rising again. Cutting rates is becoming unlikely as debt-fueled inflation is making “the last mile” to the Fed’s 2% target harder to achieve.

A lack of rate cuts could spark a vicious debt spiral. The debt death spiral refers to a situation where the country’s increasing debt leads to higher interest rates. This in turn makes it more expensive to borrow money. As borrowing costs rise, the government must allocate more funds to debt servicing, leaving less money for essential services and investments. This cycle makes the debt burden worse with further borrowing and worsening financial instability. Until the cost to service the debt chokes out the government’s ability to provide any services at all.

Effect of US Debt on the World

So goes the US, so goes the world. Our higher interest rates due to debt affect the global economy. High US interest rates attract investors seeking better returns. As investors move their funds into US assets, demand for other currencies decreases. This causes their value to drop. To counteract this depreciation and prevent capital flight, other central banks raise their interest rates. Money becomes harder to access in other countries as a result, adding the same pressures on stocks and bonds.

In addition, many state debts are tied to US interest rates. As US rates rise, the cost of borrowing and debt burden worsens. Risks rise as economic fragilities are exposed. Already unstable economies can be driven into total meltdown by forces beyond their control.

Conclusion

The IMF presented a strong case on how the astronomical US debt endangers the entire global economy. Unfortunately, the debt is only going to grow exponentially larger. And the danger is going to grow with it. A worldwide economic crisis is brewing that could have long reaching, long lasting unforeseen consequences. That’s why many Americans are moving to protect their wealth by acquiring safe haven physical gold and silver that hold their value during economic upheaval. In particular, a Gold IRA can protect the long term value of retirement funds from the effects of runaway debt. Contact American Hartford Gold today at 800-462-0071 to learn more.

4

4