- Investors are leaving an overheated stock market in record numbers

- They are driven by fear fed by years of high interest and inflation rates, political chaos, and geopolitical conflict

- Physical precious metals, especially in a Gold IRA, can diversify and protect retirement savings from stock market volatility

Investors Beat a Retreat

Economic data is pointing to some concerning trends underlying the current stock market rally. According to the numbers, US stock market is shrinking. Just as billionaires did months ago, regular investors are pulling their money out at a near-record pace.

Seen as an omen of economic trouble, Americans are strategically moving their assets to safe haven physical precious metals.

Fear is currently driving the market according to CNN’s Fear and Greed Index. The fear is fed by years of high interest and inflation rates, political chaos, and geopolitical conflict. Morgan Stanley said, “Summer 2024 may prove volatile with momentum stalling.” The market already big swings as traders react to unexpected economic data. The presidential election is only going to increase the volatility.1

Investors are losing their taste for risk and are retreating. Bank of America said their clients have been net sellers of stocks for five weeks in a row. They sold off $5.7 billion more in stocks than they purchased. That is the highest outflow since last July.

A sign that the market is in retreat is the shrinking number of public companies. JPMorgan CEO Jamie Dimon said,” The total [of public companies] should have grown dramatically, not shrunk.” He expressed concern about the implications by following up with, “This trend is serious.”2

Americans Squeezed

The retreat may go beyond simply avoiding risk. Some Americans are being squeezed out of the market. Rent, gas, food, and childcare cost 15%-40% more today than they did just three years ago. Inflation is causing 46% of US middle class workers to slash contributions to their retirement funds according to a Primerica survey. 3

The survey continued to find that 67% say their income is falling behind the cost of living. Average paychecks have risen but fallen short of the higher cost of living. As result, 36% are using credit cards to keep up with expenses. Credit card debt is now at record highs. The problem is worsened because higher interest rates have made debt increasingly expensive. With credit cards maxed out, Americans are being forced to rein in even essential spending. 4

The pausing of retirement contributions can have long term ramifications. American are going to be finding themselves unable to retire comfortably, if at all. The Primerica survey revealed almost 80% of respondents don’t think they’ll be better off next year. Meaning the retreat is likely to continue.

A Strategic Retreat

American may be pulling out the market to secure their gains. Or they may be forced to cover their expenses. Whatever the cause, exiting the market now might turn into a fortunate decision.

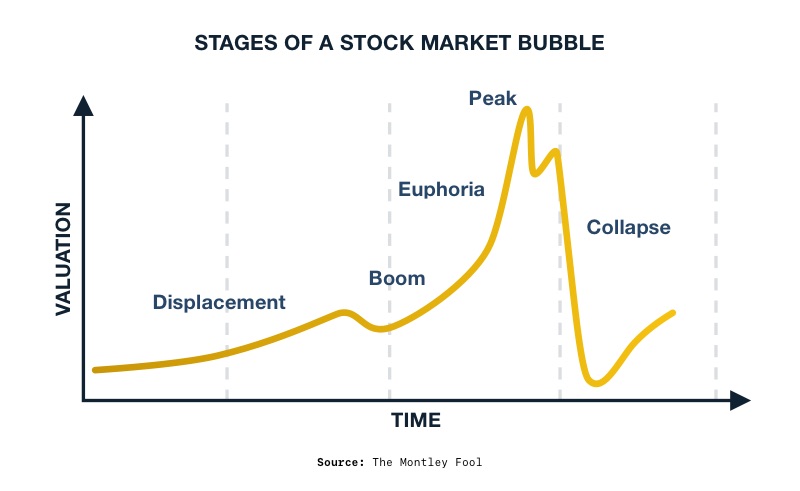

Richard Bernstein is the chief investment officer of the RBA hedge fund. He says the mega-caps stocks are overvalued and risk a big correction. As of now, the top 10 stocks in the S&P 500 make up 35% of the benchmark’s total value. That is the highest percentage ever recorded. And Goldman Sachs economists said the market looks to be the most overvalued since 1932.

5

5

Bernstein predicts the losses from a correction could rival the dot-com crash. After the boom in internet stocks, the Nasdaq Composite dropped 78% from its peak. Tech stocks continued to struggle over the next 14 years. A “lost decade” in the stock market followed, with the S&P 500 losing 1% from 1999 to 2009.6

Bernstein said, “Fundamentally, it makes zero sense. The bond market is saying corporate profits are going to be strong … but the equity market with this incredibly narrow leadership of seven companies is saying that it’s an apocalyptic earnings outlook. I think the stock market’s in a bubble and the bond market is right.”7

Time to Diversify

Modern portfolio theory stresses diversifying your assets when the stock market is overvalued and on the verge of crashing. Converting assets into physical precious metals is a time-tested diversification strategy. Gold has historically maintained its value during economic downturns, offering a safe haven against inflation and recession.

Conclusion

As money becomes tighter, each decision about saving for your retirement carries greater weight, necessitating assets that can preserve wealth. Unlike stocks, which can plummet during market corrections, gold typically retains or even increases in value, providing stability and protection for your portfolio. By including gold, you mitigate risk, ensuring a portion of your nest egg is safeguarded against the volatility and uncertainties of a financial crisis. And by opening a Gold IRA, you can gain tax advantages along with the wealth protection benefits of physical precious metals. Call us today at 800-462-0071 to learn more.

Notes:

1. https://www.cnn.com/2024/06/05/investing/premarket-stocks-trading/index.html

2. https://www.cnn.com/2024/06/05/investing/premarket-stocks-trading/index.html

3. https://moneywise.com/retirement/middle-class-workers-are-slashing-or-cutting-contributions-to-retirement-funds

4. https://moneywise.com/retirement/middle-class-workers-are-slashing-or-cutting-contributions-to-retirement-funds

5. https://markets.businessinsider.com/news/stocks/stock-market-outlook-correction-dot-com-bubble-crash-buy-opportunity-2024-6

6. https://markets.businessinsider.com/news/stocks/stock-market-outlook-correction-dot-com-bubble-crash-buy-opportunity-2024-6

7. https://markets.businessinsider.com/news/stocks/stock-market-outlook-correction-dot-com-bubble-crash-buy-opportunity-2024-6

1

1

3

3