- Gold prices are consolidating around an impressive $2,400 an ounce

- Gold demand is being fueled by geopolitical conflicts, strong central bank purchasing and safe haven demand from rising inflation and growing debt

- Gold is predicted to break $3,000 an ounce within six to eighteen months.

Gold Prices Consolidate at New Highs

Coming off a streak of record-breaking highs, the price of gold appears to be entering a consolidation phase around an impressive $2,400 an ounce. Gold’s momentum is overcoming traditional negative correlations. As it settles into this new price range, gold is poised to resume its upward trajectory.

Gold’s consolidation phase refers to a period in which the price of gold trades within a relatively narrow range. During this phase, the market is in a state of balance. It remains stable until new developments motivate more buying and selling. Consolidation phases usually occur after periods of rapid price increases. They are characterized by reduced volatility and trading activity. They can serve as a pause or breather in the market before the next significant move in either direction.

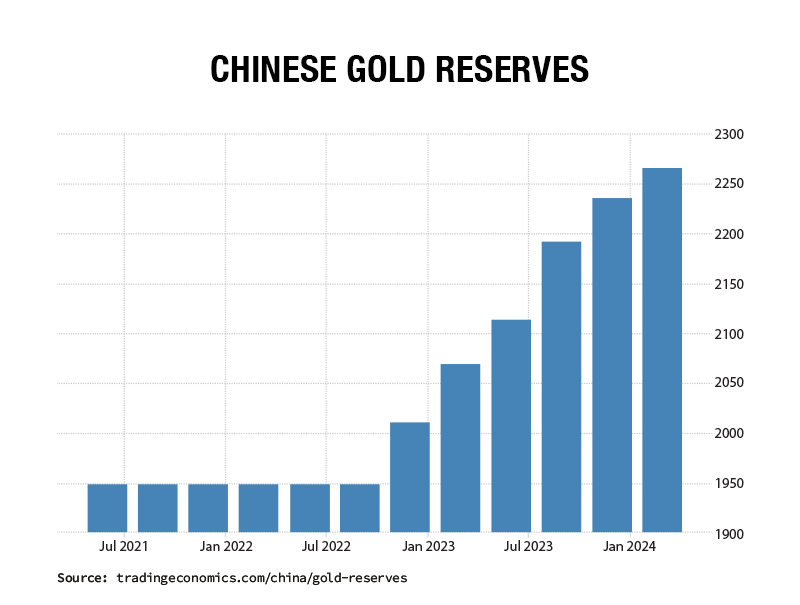

Right now, gold is consolidating around $2,400 an ounce – a new record weekly close for the precious metal. Gold’s rally to this price is breaking long held fundamental beliefs. It resisted downward forces like high interest rates and a strong dollar. Gold is benefiting from overall increased demand. That demand is fueled by the geopolitical conflicts in Ukraine and the Middle East. Gold is also fulfilling safe haven demand for investors as stocks struggle to maintain their near record highs. Central banks and individuals are rapidly acquiring gold as a hedge against inflation as it creeps upwards again.  1

1

Go to Gold

Ryan McIntyre is a managing partner at Sprott Inc. He said during this economic cycle, investors should move away from the S&P 500 and into gold. He is looking past the normal headwinds brought by high interest rates. Instead, McIntyre thinks that the S&P 500 is very expensive right now compared to how much money companies are making (a measure called the Shiller Price to Earnings Ratio). Holding onto these expensive stocks might not be the best idea because it would require companies to make a lot more money in the future to justify these high prices. So, instead of investing in expensive stocks, McIntyre sees gold as a potentially better investment option.2

Gold is positioned to take advantage of any new changes in the economy. A rate hike from the Fed would increase holding costs for gold but it will hurt the value of stocks as well. “A rate hike will be bad for gold, but it will be a lot worse for the S&P 500,” according to McIntyre. 3

The rapidly growing national debt is also powering gold demand. US Treasuries aren’t offering the same wealth protection. Gold is still coming ahead as the easiest and trustworthy of safe haven assets.

Gold & Interest Rates

Gold is even breaking with its normal correlation to interest rates. Recently, Federal Reserve Chair Jerome Powell surprised markets with a hawkish comment. Inflation was coming in hotter than expected. Powell cast doubt on its readiness to cut interest rates. Gold prices, instead of dropping, were unfazed by the comment.

A softer than expected jobs report renewed expectations on potential interest rate cuts. “We continue to expect two rate cuts this year, in July and November,” Goldman Sachs wrote in a note. Gold climbed on the news. As a matter of fact, the forces holding gold prices down seem to be weakening. “The downside that we’ve seen over the last few weeks might actually be running out of steam, opening (the) door for gold prices to resume their upward trajectory,” said Daniel Ghali, commodity strategist at TD Securities.4

The Fed must ultimately lower interest rates at some point in time. And when that happens, gold prices could surge again in what is expected to be a protracted bull market.

Future Prices

Analysts from Citigroup have predicted that gold, “aided by geopolitical heat” and “coinciding with record equity index levels,” could surpass the price of $3,000 per ounce in the following six to 18 months. According to Citigroup, the demand is likely to be coming from managed money players who are catching up with central bank demand. 5

Bloomberg’s senior commodity specialist Mike McGlone is also certain that gold would hit the $3,000 price per ounce. He cites the combination of two financial indicators – the lowest CBOE S&P 500 Volatility Index (VIS) and the highest US Treasury bill rates since 2007.6

Conclusion

Gold prices are consolidating at a new high level. Demand is backed by geopolitical conflict, central bank buying, and rising inflation. Debt fears and potential interest rate cuts are also supporting gold. Analysts see this plateau as a springboard for gold to reach even greater heights. Now is an excellent time to learn how adding gold to your portfolio with a Gold IRA can protect and potentially increase your wealth. Call American Hartford Gold today at 800-462-0071 to learn more.

Notes:

1. https://www.americanhartfordgold.com/gold-price-charts/

2. https://www.kitco.com/news/article/2024-05-07/its-no-brainer-switch-sp-500-gold-sprotts-ryan-mcintyre

3. https://www.kitco.com/news/article/2024-05-07/its-no-brainer-switch-sp-500-gold-sprotts-ryan-mcintyre

4. https://www.cnbc.com/2024/05/06/gold-rises-on-fed-rate-cut-hopes-middle-east-tensions.html

5. https://finbold.com/heres-when-gold-price-could-hit-3000/

6. https://finbold.com/heres-when-gold-price-could-hit-3000/

2

2