- The Federal Reserve cut interest rates in November based on slowing inflation and a weakening job market

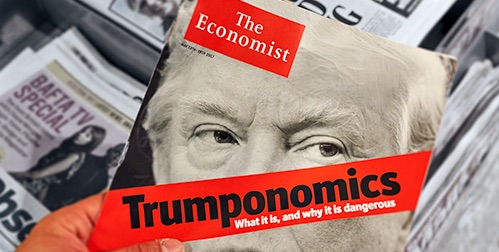

- Conflict between the Fed and Donald Trump is making the future of rate cuts uncertain

- Physical precious metals can preserve fund value no matter which side’s policy prevails

Trump, The Fed & Uncertainty

After holding interest rates near record highs for two years, the Fed issued their second cut since September. Motivated by recession fears, the cut is meant to help spur a lagging job market. But the Fed’s future policy could be thrown into turmoil as it collides with President-elect Trump’s bold economic agenda. The heightening uncertainty has insiders taking refuge in safe haven assets like precious precious metals.

Rate Cut

The Fed’s dual mandate of maximum employment and price stability has them walking a tightrope. With inflation dropping from its record high 9.1%, the Federal Reserve cut interest rates by a quarter of a point in November. However, high interest rates still have the economy in a “strangle hold” posing a risk to the job market.1

Data shows the risks of the job market collapsing and inflation reigniting are the same now. There were 7.4 million job openings in September. Down considerably from 9.3 million that time last year. Unemployment is also up from last year – raising fears of recession.

2

2

Future Cuts

Several more rate cuts were expected for 2025. The number of cuts is now uncertain due to potential impacts from Trumps proposals. His plans for tax cuts, deregulation, and tariffs could cause inflation to rise and deficits to grow. In response, the Fed may not only stop cutting rates. They may feel it necessary to raise them again. Nomura Bank expects just one more cut in 2025 if Trump quickly implements his plans.

Trump vs the Fed

Despite economic data, Powell acknowledged that Americans have a poor view on the economy due the “lingering trauma of high inflation.” It’s that lingering trauma that helped re-elect Donald Trump.

Officially, the Federal Reserve decision making is independent of the government. Its independence is to protect it from short term political decision making. In the Fed’s own words, it was “designed to carry out its responsibilities without interference or control from the vested interests inherent in electoral politics, fiscal policymaking, and private banking.”3

Alan Greenspan, a five-term Fed chair, said in 1996. “The clear political preference for lower interest rates would unleash inflationary forces, inflicting severe damage on our economy.”4

Trump does not hide that he is no fan of the Fed. During his first term, he publicly attacked Powell after raising rates to fight inflation. Trump said about Powell: “He was supposed to be a low-interest-rate guy. It turned out he’s not. … I’m very unhappy with the Fed because Obama had zero interest rates.” Interestingly enough, it was Trump who first nominated Powell. 5

Control of Monetary Policy

Trump wants a voice in the central bank’s interest rate decisions. he said: “I think I’m better than most people would be in that position. I think I have the right to say, ‘I think you should go up or down a little bit.’ I don’t think I should be allowed to order it, but I think I have the right to put in comments as to whether or not interest rates should go up or down.”6

To that end, Trump maintains that he has ” the right to remove him [Powell].” When asked if Trump has the power to fire him, Powell said no. And demoting him is not permitted under law.

Powell said in the short term, the election won’t impact decision making. He implied another expected cut in December is likely to go ahead. That decision is still dependent on unemployment and inflation data.

Impact of Interference

If political pressure starts to tamper with the Federal Reserve’s independence, the ripple effect could extend far beyond Wall Street. Experts warn that undermining the Fed’s credibility would shake global financial stability. The concern isn’t just about interference from political figures. It’s about the risk of eroding trust in the Fed’s ability to manage inflation. If inflation expectations rise, the Fed might be forced to take drastic measures to regain control. Potentially plunging the economy into a deeper downturn. At worst, such moves could make the U.S. appear less like a stable economy and more like an unpredictable autocracy. The value of the dollar and goods at the whim of political agendas.

Defense Against Uncertainty

The only certainty about the tug of war between the President and the Federal Reserve is heightened uncertainty. To defend against that uncertainty, financial experts are looking to gold.

Historically, gold has held its value through economic and political upheavals. This year alone, gold prices have surged by over 30%. By 2025, some expect they could reach as high as $3,000 per ounce.

Gold is positioned well who wins control for monetary policy. Gold can preserve purchasing power against Trump’s inflationary pressures. Gold can also help shield against losses resulting from a recession triggered by the Fed being forced to raise rates. And a Gold IRA offers long term protection if these adversarial forces drag the economy into a prolonged downturn. To learn how to protect you retirement before it is too late, contact us today at 800-462-0071.

3

3

2

2