- Americans may be exposed to higher taxes due to last year’s record Social Security cost of living increase

- Millions of new remote workers are vulnerable to being taxed twice on the same income

- A Gold IRA can shield savings from this administration’s aggressive tax policies

Higher Taxes in 2024

Older Americans grappling with the severe consequences of stubborn inflation may soon find themselves facing another harsh reality – higher taxes. 2023’s record high Social Security benefits increase could result in a new, heavier tax burden. And the army of new remote workers may also be caught in a tax trap. Fortunately, there are means to escape the impact of this administration’s heavy tax policy.

Taxes on Social Security Benefits

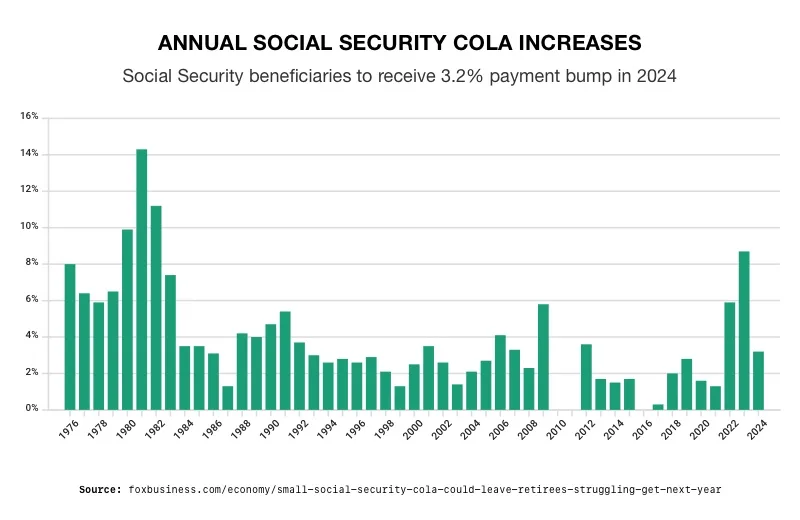

Social security recipients receive a cost-of living (COLA) increase indexed to inflation. The current inflation crisis resulted in an 8.7% COLA increase last year. That is the biggest increase since 1981. The Social Security Administration said more than 66 million people received higher benefits last year. The average monthly payment jumped up around $140. The boost could push more seniors into higher tax brackets.1

2

2

The problem is that the amount of benefits exempted from taxes hasn’t changed since 1984. Recipients owe taxes on benefits if their adjusted gross income is more than $25,000 if they are single and $32,000 if they are a married couple. Individuals earning more than $34,000 and couples earning more than $44,000 can be taxed up to an astonishing 85% of their benefits.3

Surveys show this jump in taxes could come as a surprise to many seniors who have never owed taxes on their benefits before. “We really expect a huge bump in the number of people who will be paying taxes on their social security benefits this year, sadly,” said Shannon Benton, executive director of the Senior Citizens League. 4

A recent study showed 23% of retirees had to pay taxes on benefits for the first-time last year. That number is projected to rise significantly in 2024 as there will be another COLA increase of 3.2% this year.

Economists recognize the tax trap the government is laying out. “It’s kind of a Catch-22,” Benton said. “It’s like, ‘OK, give me a raise, but then take more of it away.’ So, they’re getting this increase every year that they desperately need, but the [tax] thresholds have never been increased.”5 Higher monthly income can also reduce senior eligibility for income-sensitive government programs such as Medicare. 6

Surprise Remote Work Tax

The pandemic redefined work. There are now 35 million people working remotely. While remote work may bring several perks, it can also come with a nasty tax surprise. Depending on where you live and where your employer is based, remote workers may be subject to the income tax rules of two – or more – states. Individuals can be taxed based on both where they live, and where they earn income.

Several states tax people based on where their office is located, whether they physically work in the state or not. If an employee’s home state doesn’t offer a tax credit, or if they don’t live in an income tax free state, they can be stuck paying taxes twice on the same income.

Jared Walczak is the vice president of state projects at the Tax Foundation. He said, “some [people] are unfortunate enough to work for companies based out of states that have what’s called a convenience rule, which can result in two states taxing the same income without any adjustment.”7

Conclusion

Increasing taxes are becoming a staple of this administration and Americans can expect more if the administration doesn’t change in November. There are strategies to try and limit the impact of these taxes. If you are already retired, it may be possible to avoid having Social Security benefits taxed by limiting withdrawals from a traditional retirement plan.

However, that could result in not having enough money to pay your bills. Especially as inflation continues to erode purchasing power. As it is, nearly 3 in 5 seniors report struggling financially to cover the costs of necessities like food, rent, and medical care. Prices are up a shocking 17.23% when compared to January 2021.8

For those not yet retired, the Motley Fool suggests saving for retirement in a Roth account instead of a traditional savings plan. Roth IRA and 401(k) withdrawals aren’t taxed, and they’re not factored into combined or provisional income. To gain additional protection from inflation, people can investigate a Roth Gold IRA. It combines tax advantages with the wealth protection offered by physical precious metals. To learn more about how you can secure your financial future, contact American Hartford Gold today at 800-462-0071.