- The Federal Reserve opted not to raise interest rates at their most recent meeting

- The pause is most likely temporary, with the Fed suggesting future rate hikes later this year

- Pause or no pause, interest rates will continue to inflict pain on Americans

Fed Pauses Rate Hikes

After raising rates at its fastest pace in 40 years, the Federal Reserve announced they are hitting the pause button on hikes for now. This marks an end to 10 straight increases. Beyond failing banks and bear markets, the Fed’s inflation taming policy has impacted regular Americans. Rate hikes have driven borrowing costs above 5%. The cost of auto loans, credit cards, and mortgages have all risen higher – leaving consumers with less cash to spend. So, while this pause won’t add to the pain, it is unlikely to help.

1

1

The pause may even be short lived. The Fed left a return to hikes on the table, saying additional rate hikes are probable later this year. The decision to skip a rate increase this meeting was unanimous among officials. The Fed will assess further information and its impact on monetary policy before making future moves. Economic indicators, including the job market and credit conditions, will play a crucial role in determining the size and timing of future rate hikes. Tightening lending standards by banks and potential limitations on accessing credit could dampen economic activity, hiring, and inflation.

Some analysts think renewed rate increases could be disastrous. High rates exposed vulnerabilities in the financial system. Resuming rate hikes could shake public confidence by causing more damage like failing banks. Or they could trigger a something that sets the economy into a tailspin. Laura Rosner-Warburton is a senior official at MacroPolicy Perspectives and a former staffer at the New York Fed. She said, “Keeping rates at these levels will pull more skeletons out of the closet.”2

A Pause is No Help

Greg McBride is the Chief Financial Analyst at Bankrate.com. “A pause won’t bring borrowing rates lower, particularly for variable rate debt such as credit cards and home equity lines of credit that have increased in step with the Fed’s 10 previous interest rate hikes,” McBride said. Right now, the average APR on a new credit card offer is a towering 23.98%, according to LendingTree. And they are predicted to creep higher in the immediate future, even with the pause.

“Elevated inflation and a strong labor market mean the Fed is nowhere close to cutting interest rates, so borrowers will continue to be dealing with high interest rates for months to come, even if the Fed doesn’t hike rates further,” said McBride. 3

An Uncertain Federal Reserve

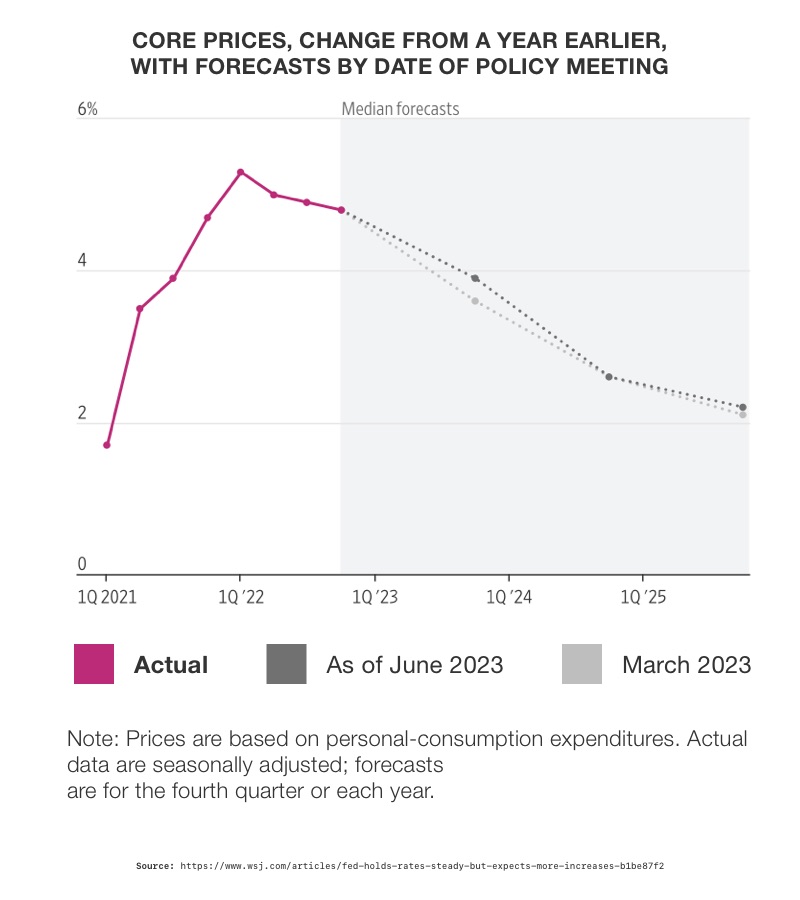

The Federal Reserve may be taking a pause to figure just what exactly is happening with the economy. The Fed started their aggressive rate policy to fight inflation. They know rate hikes can take more than a year to have a full impact. According to some data, that policy is working. Inflation had spiked at 9.1% in June last year. It has fallen to 4% according to the May Consumer Price Index report. Meanwhile, the labor market is booming, home prices are holding up, and consumers are still spending.

4

4

But the data isn’t so clear upon closer examination. The most recent US employment report provided a confusing mix of information. Companies added a strong 339,000 jobs in May, but households reported higher unemployment.

Inflation, meanwhile, has steadily dropped, but key services sectors — where wages are one of the biggest expenses — are still seeing higher price increases than the Fed would like. The slowing of inflation might have as much to do with easing supply chains and depleted government spending as it does with higher rates.

Mortgage rates shot up, putting a significant dent in the market. New listings are down 23%, and pending sales are down 17%. But a housing shortage, combined with the fact that so many homeowners locked in low rates during the pandemic, has meant that prices haven’t dropped significantly. People looking to move have fewer options, and people who own aren’t eager to give up their cheap rates.5

Navigating the Future

Despite the Federal Reserve’s decision to pause interest rate hikes, struggling consumers should not expect immediate relief. High borrowing costs across various sectors, coupled with inflation concerns and uncertainties in the economy, will continue to pose financial challenges. Taking proactive steps to pay down debt and manage financial obligations can help individuals navigate these difficult times. So can safe haven assets that protect purchasing power during times of high interest rates. A Gold IRA from American Hartford Gold can preserve the value of your retirement funds as Federal Reserve policy plays out. To learn more, contact us today at 800-462-0071.