Inflation Continues to Rise

After the most aggressive rate hikes in recent memory, inflation appeared to be on a downward trajectory. That appearance seems to be an illusion. Back-to-back reports showed that prices are rising again. Goldman Sachs CEO David Solomon warned

that prices could stay high for a very long time. While economic optimism is running high on a record stock market, Solomon says, “The U.S. economy has proven more resilient than expected, and markets are predicting rate cuts, though I think inflation may prove stickier than many anticipate.”1

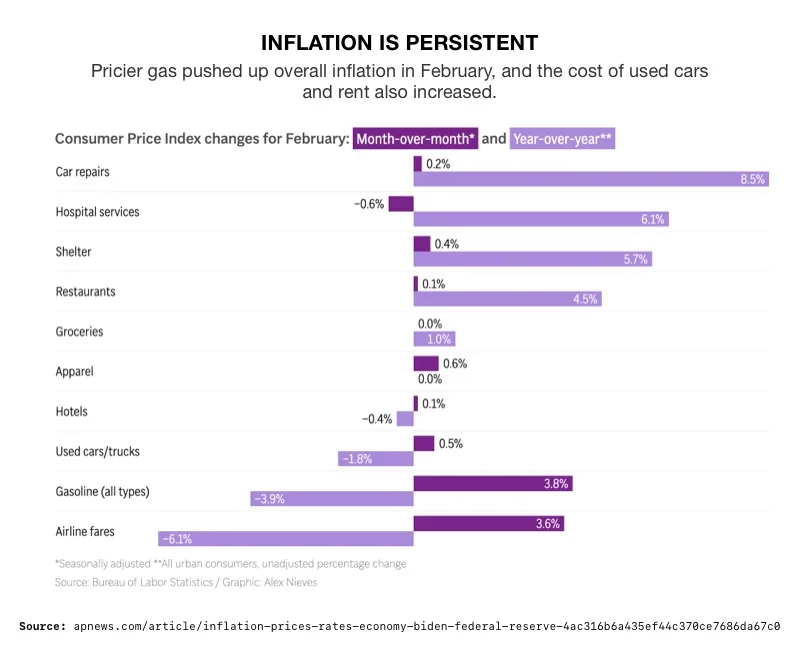

Consumer prices jumped up last month, rising higher from January to February. They were higher than the previous month’s increase as well. Core inflation, which excludes volatile food and energy prices, also climbed. Costs rose across the board. Gas prices, air fares, and clothing all went up. The cost of some services such as car repairs are rising faster than they did before the pandemic.

2

Inflation has been lingering for years now. It surged on everything in 2021 and 2022 because of supply chain disruptions, a tight labor market, and increased consumer demand from unprecedented government stimulus payments. Inflation has fallen from its peak of 9.1% in June 2022. But when compared with January 2021, prices are up an astonishing 18.49%.

Aggressive interest rate hikes slowed inflation initially. However, progress on inflation has largely flatlined since last June. The Consumer Price Index has been hovering around 3% for the past nine months. With interest rates slowing growth and inflation lingering, renewed fears of stagflation have risen.

Marko Kolanovic is Chief Global Markets Strategist at JPMorgan. He points to the rapid rise in stock prices as a signal for a second wave of inflation. He counters the optimism that we are in a ‘parabolic stock market’ where stock prices are going up at an exponential rate. He doesn’t agree with traders who are describing the current state of the stock market as “Platinum-locks”—an even more desirable version of Goldilocks.

Kolanovic cites tight labor markets, high immigration and continued massive government spending are reasons why inflation may move higher. All the quantitative tightening, the Fed removing money from the system, is being undone by continued government spending. And Nvidia’s meteoric rise, adding the equivalent of the market capitalization of the bottom 100 companies in the S&P 500, infused even more cash into the system.3

Economists point to historical parallels to indicate that a second wave of inflation is coming. In the 1970s, high inflation came in three separate waves. Each wave was connected to a different geopolitical event. Those events included proxy wars, Middle East conflicts and oil embargos and an increase in deficit spending. These conditions fueled inflation and put a drag on the economy. Stocks were basically flat from 1967 to 1980.

Today, the world is experiencing a similar situation. There is a proxy war is Eastern Europe, conflict in the Middle East with disruptions to oil shipping. Deficit spending has hit record levels. Hence the belief that a second wave of inflation is on the way.

Rate Cuts & Stagflation

Many economists had expected the Fed’s first interest rate cuts to occur in June. Rising unemployment gave the impression of a slowing economy, the green light for cuts. However, the fact that inflation is no longer slowing and is increasing may change the June prediction.

Current conditions can feed into a stagflation ‘feedback loop’. The disruption of global trade, supply chains and economies lead to higher inflation and growing deficits. This leads to higher interest rates, economic slowdowns, and lower stock prices. As a result, stagflation occurs. Then the only thing that can break the loop is a major economic shock, like a severe recession, to ‘reset’ the system. This economic reset often leaves a path of economic carnage with retirement savings in left in shambles.

Conclusion

At first glance, the economy seems to be on the rebound. Inflation looked like it was on the decline. The stock market is surging. And Wall Street thinks the Fed is just months away from cutting interest rates and refueling the country’s economic engine. But recent reports present a different case. High interest rates haven’t curbed inflation, it is growing again. What they have done is curb growth. Predicted interest rate cuts now look more uncertain. And rampant government spending in undoing the Fed’s effort to tighten the money supply.

Based on history, another wave of inflation could be on the way. A wave that results in stagflation-like conditions. Americans who want to preserve the value of their savings before that wave breaks should investigate a Gold IRA from American Hartford Gold. It uses the inherent value of precious metals to protect retirement savings. Contact us today at 800-462-0071.

Notes: