Economic Indicators Point to Stagflation

As inflation remains stubborn and growth continues to slow, the threat of stagflation is causing economists to sound the alarm. Last seen in the 1970s, stagflation wreaks havoc on the economy and can ruin retirement funds. Past episodes of stagflation have weighed heavily on stocks. The S&P 500 fell an average of 2.1% during quarters marked by stagflation over the past 60 years. There are several factors pointing to the rise of stagflation. Meanwhile, gold is demonstrating its potential resilience in times of economic turmoil.1

Bank of America’s Global Research’s April survey of global fund managers showed expectations of stagflation near historic highs, with 86% saying it will be part of the macroeconomic backdrop in 2024.2

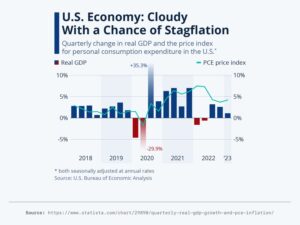

Stagflation is defined as a combination of high inflation, stagnant growth, and high unemployment. Analysts say we are now in ‘stagflation lite.’ Inflation remains near its highest levels in decades and disinflation is slowing down. US economic growth has been on a downward trajectory for the past few years. 3

The below chart depicts the current, stagflation lite conditions:

4

4

Inflation

The Federal Reserve continues to raise interest rates to tame inflation. While moderating, inflation still remains high.

“While most investors focus on the consumer price index (CPI), the Fed’s favored measure of inflation is the core personal consumption expenditures (PCE) index. Core PCE, which excludes food and energy prices, climbed 0.3% in March after an 0.3% advance in February. “5

Sticky inflation suggests the prospect of higher rates for longer. It also adds fuel to the banking crisis fire. Rapid interest hikes have been blamed for the collapse of three banks within weeks of each other. And as hikes continue, banks are under further stress. Not only are their assets being devalued. Banks must compete against Treasuries for savings deposits for the first time in many years.

Stagnant Growth

Fed policy is pushing the economy into recession. Higher interest rates are slowing economic activity, particularly in manufacturing. The Institute for Supply Management’s April Manufacturing Index painted another dismal picture nationwide. This index has shown economic contraction for six consecutive months. The lack of liquidity is worsened by the bank failures. They will most likely be limiting lending in all but the safest circumstances.

Unemployment

The only thing missing is rising unemployment, or is it? Strong job reports have the Fed insisting they must maintain high interest rates. That a strong job market shows more contraction is necessary to tame inflation.

Yet there are discrepancies with the unemployment data. In most of the ten US states with the lowest and highest unemployment rates, initial claims are trending both higher and at an accelerated rate over the past three to six months. This is at odds with the current publicly available federal unemployment data.

Unemployment is rising rapidly based on initial claims for unemployment (in both high and low employment states) and WARN filings (in 39 US states). WARN filings are the Worker Adjustment and Retraining Notifications. They help ensure advance notice of plant closings and mass layoffs. These increases are not being captured in the reports of the Bureau of Labor Statistics or other federal sources.

These factors – inflation, recession, and rising unemployment, are indicators that we may be entering a period of stagflation.

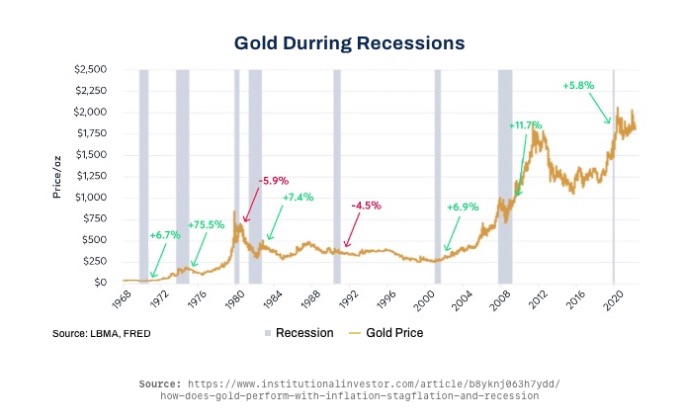

The Role of Gold

As economists analyze the potential impact of stagflation, it is crucial to consider the role of gold during uncertain times. Gold has historically exhibited resilience during economic downturns. Gold prices soared in the 1970s stagflation. It outperformed the S&P 500 in six out of the last eight recessions by an average of 37%. Historically, from 6 months before the start of recession to 6 months after, gold rallied 28% on average.6

7

7

One reason gold rises is that the Fed has historically cut rates during a recession and injected liquidity. This reduces the opportunity costs of holding gold. As investors shy away from sinking stocks, gold is seen as a safer alternative.

A noteworthy occurrence is the correlation between recent headlines highlighting banking stress and a notable rally in gold prices. From March 8 to April 24, gold prices surged by 9%, outpacing the S&P 500.8 This rally indicates a growing perception among investors that economic uncertainties might increase, leading them to seek refuge in the precious metal. One way to protect your retirement funds from stagflation is opening a Gold IRA. Contact American Hartford Gold at 800-462-0071 to learn more.