JPMorgan Chase CEO Sounds the Alarm

JPMorgan Chase CEO Jamie Dimon sounded the alarm on the severe risks facing the global economy. Citing a variety of reasons, Dimon said investors may be working in the most unstable period in recent memory. And that the economy is at a “pivotal moment for America and the free world.” Precious metals like gold and silver are breaking historic highs as the level of uncertainty skyrockets.

In the JPMorgan earnings press release, Dimon said, “This may be the most dangerous time the world has seen in decades.”¹ His outlook is based on numerous escalating risks, including the following:

Quantitative tightening (QT): QT is the Fed’s policy of removing money from the system. The policy had to be cut short the one time it was used before because banking reserves were being drained. QT is currently removing liquidity from the economy and limiting “market-making capabilities.”

Interest Rates: The stock market boomed over optimism for rate cuts this year. Dimon fears rates may actually go up because Inflation has been ‘sticky’ and could go higher. The increase is also possible due to a tight labor market and massive government deficit spending.

US Debt: Dimon has called the debt “the most predictable crisis” and it could have a catastrophic effect on the economy. He points out that the supposed strength of the economy is being fueled by government spending and rising deficits. The danger presented by debt is causing a call to action from Wall Street, the government, and academia.

Geopolitical Conflicts: The Ukraine and Israeli conflicts are adding pressure to energy and food markets, global trade, and international tensions. The global economy is also facing shocks from a rising BRICS+ Alliance and a green energy transition.

Domestic Divisions: The upcoming Presidential election is exposing and enflaming deep political divisions at home. The country is grappling with issues of security, healthcare, and immigration.

Artificial Intelligence: Dimon believes the impact of AI will be extraordinary and transformational. He compares it to the printing press, the steam engine, electricity, and the Internet. The IMF predicts nearly 40% of global employment could be disrupted by AI. The current stock market boom is being powered by a handful of AI related companies. Chipmaker Nvidia is up more than 219% over the last 12 months.²

Precious Metals

³

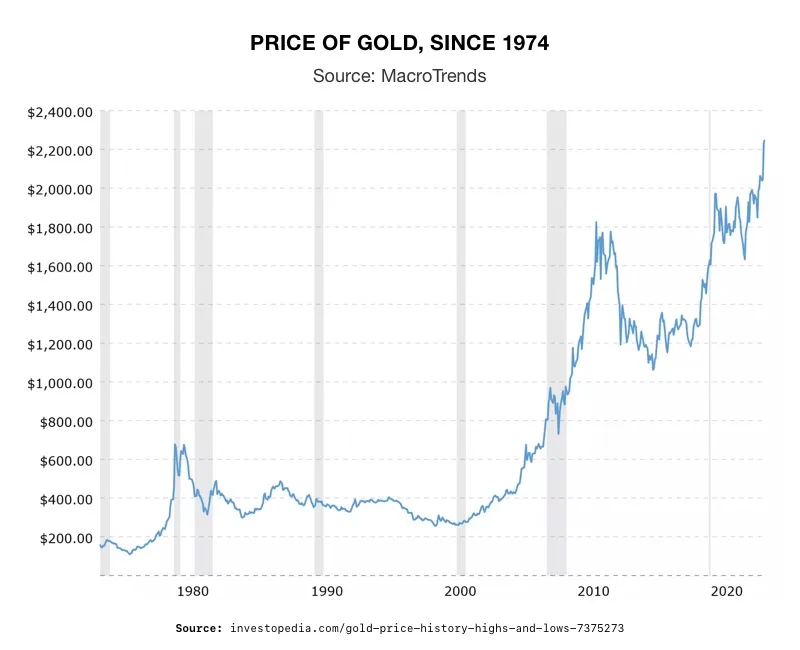

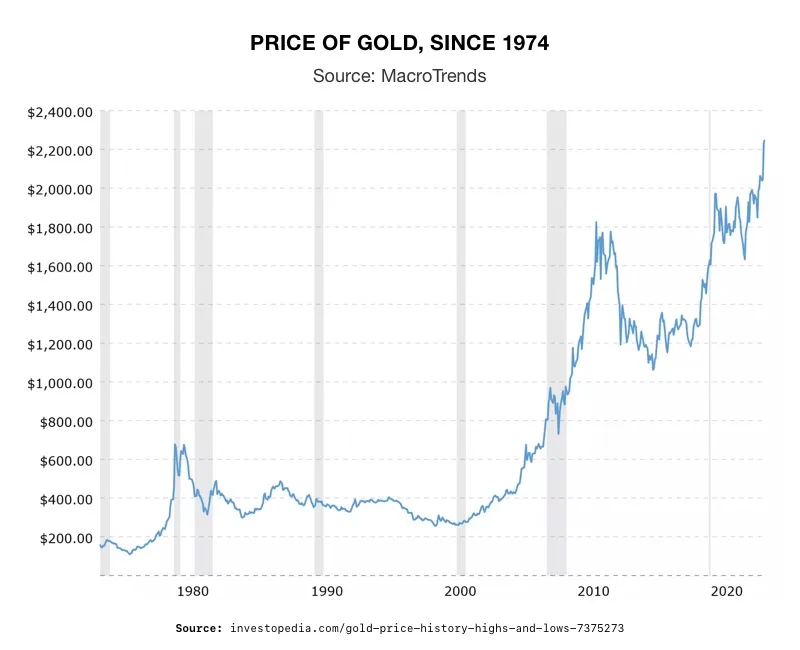

The state of the precious metals market is often looked at as a barometer for the global economy. Thus, it makes sense with all the fear and trepidation in the world that gold prices are shattering records. They have repeatedly climbed to all-time highs in recent weeks. Gold traded at $2,327 an ounce after briefly hitting a fresh record of $2,372.⁴

Wall Street expects the strength in gold prices to continue until at least through the second half of the year. Citi has called gold a developed market “recession hedge.” And heightened volatility in Ukraine and Israel could provide further support. In addition, gold demand is reaching a ‘sweet spot’ where inflation remains elevated, but interest rates are no longer increasing. However, analysts are amazed that the momentum for gold has completely broken away from its traditional correlation to real interest rates and the dollar.

Meanwhile, BNP Paribas is saying to keep an eye on silver. Gold and silver prices have traditionally shown a strong positive correlation. Silver hit a 2-year high, recently reaching $27 an ounce. Global silver demand is forecast to reach 1.2 billion ounces in 2024, which would mark the second-highest level on record, the Silver Institute said in a recent report.⁵

Conclusion

Dimon ultimately warned that traders are paying too much attention to the short term moves by the Fed instead of focusing on long-term risks. “The impacts of these geopolitical and economic forces are large and somewhat unprecedented,” he wrote. “They may not be fully understood until they have completely played out over multiple years.”⁶ With this level of uncertainty, adopting a defensive strategy is prudent. Especially with gold and silver poised to keep increasing in value. Contact American Hartford Gold today at 800-462-0071 to learn how a Gold IRA can protect your retirement funds during these dangerous times.

Notes:

³

The state of the precious metals market is often looked at as a barometer for the global economy. Thus, it makes sense with all the fear and trepidation in the world that gold prices are shattering records. They have repeatedly climbed to all-time highs in recent weeks. Gold traded at $2,327 an ounce after briefly hitting a fresh record of $2,372.⁴

Wall Street expects the strength in gold prices to continue until at least through the second half of the year. Citi has called gold a developed market “recession hedge.” And heightened volatility in Ukraine and Israel could provide further support. In addition, gold demand is reaching a ‘sweet spot’ where inflation remains elevated, but interest rates are no longer increasing. However, analysts are amazed that the momentum for gold has completely broken away from its traditional correlation to real interest rates and the dollar.

Meanwhile, BNP Paribas is saying to keep an eye on silver. Gold and silver prices have traditionally shown a strong positive correlation. Silver hit a 2-year high, recently reaching $27 an ounce. Global silver demand is forecast to reach 1.2 billion ounces in 2024, which would mark the second-highest level on record, the Silver Institute said in a recent report.⁵

Conclusion

Dimon ultimately warned that traders are paying too much attention to the short term moves by the Fed instead of focusing on long-term risks. “The impacts of these geopolitical and economic forces are large and somewhat unprecedented,” he wrote. “They may not be fully understood until they have completely played out over multiple years.”⁶ With this level of uncertainty, adopting a defensive strategy is prudent. Especially with gold and silver poised to keep increasing in value. Contact American Hartford Gold today at 800-462-0071 to learn how a Gold IRA can protect your retirement funds during these dangerous times.

Notes:

³

The state of the precious metals market is often looked at as a barometer for the global economy. Thus, it makes sense with all the fear and trepidation in the world that gold prices are shattering records. They have repeatedly climbed to all-time highs in recent weeks. Gold traded at $2,327 an ounce after briefly hitting a fresh record of $2,372.⁴

Wall Street expects the strength in gold prices to continue until at least through the second half of the year. Citi has called gold a developed market “recession hedge.” And heightened volatility in Ukraine and Israel could provide further support. In addition, gold demand is reaching a ‘sweet spot’ where inflation remains elevated, but interest rates are no longer increasing. However, analysts are amazed that the momentum for gold has completely broken away from its traditional correlation to real interest rates and the dollar.

Meanwhile, BNP Paribas is saying to keep an eye on silver. Gold and silver prices have traditionally shown a strong positive correlation. Silver hit a 2-year high, recently reaching $27 an ounce. Global silver demand is forecast to reach 1.2 billion ounces in 2024, which would mark the second-highest level on record, the Silver Institute said in a recent report.⁵

Conclusion

Dimon ultimately warned that traders are paying too much attention to the short term moves by the Fed instead of focusing on long-term risks. “The impacts of these geopolitical and economic forces are large and somewhat unprecedented,” he wrote. “They may not be fully understood until they have completely played out over multiple years.”⁶ With this level of uncertainty, adopting a defensive strategy is prudent. Especially with gold and silver poised to keep increasing in value. Contact American Hartford Gold today at 800-462-0071 to learn how a Gold IRA can protect your retirement funds during these dangerous times.

Notes:

³

The state of the precious metals market is often looked at as a barometer for the global economy. Thus, it makes sense with all the fear and trepidation in the world that gold prices are shattering records. They have repeatedly climbed to all-time highs in recent weeks. Gold traded at $2,327 an ounce after briefly hitting a fresh record of $2,372.⁴

Wall Street expects the strength in gold prices to continue until at least through the second half of the year. Citi has called gold a developed market “recession hedge.” And heightened volatility in Ukraine and Israel could provide further support. In addition, gold demand is reaching a ‘sweet spot’ where inflation remains elevated, but interest rates are no longer increasing. However, analysts are amazed that the momentum for gold has completely broken away from its traditional correlation to real interest rates and the dollar.

Meanwhile, BNP Paribas is saying to keep an eye on silver. Gold and silver prices have traditionally shown a strong positive correlation. Silver hit a 2-year high, recently reaching $27 an ounce. Global silver demand is forecast to reach 1.2 billion ounces in 2024, which would mark the second-highest level on record, the Silver Institute said in a recent report.⁵

Conclusion

Dimon ultimately warned that traders are paying too much attention to the short term moves by the Fed instead of focusing on long-term risks. “The impacts of these geopolitical and economic forces are large and somewhat unprecedented,” he wrote. “They may not be fully understood until they have completely played out over multiple years.”⁶ With this level of uncertainty, adopting a defensive strategy is prudent. Especially with gold and silver poised to keep increasing in value. Contact American Hartford Gold today at 800-462-0071 to learn how a Gold IRA can protect your retirement funds during these dangerous times.

Notes: