Gambling on Rate Cuts Likely a Losing Bet

Wall Street is riding an all-time S&P high. With a 16% increase in just three months, the market surge is attributed to a belief in upcoming rate cuts. But that ride may soon be coming to a sudden, painful stop. Two thirds of respondents to a recent Bloomberg Market Live Pulse survey said betting on early rate cuts is the “most foolish” trade to make in 2024.1

More than two thirds said the big gains at the end of last year resulted from traders becoming too optimistic, too fast. The market took off when Fed Chair Powell indicated that monetary conditions were sufficiently restrictive. Inflation expectations came down and stocks rallied. Investors bid up everything from stock to junk bonds in hopes of rate reductions.

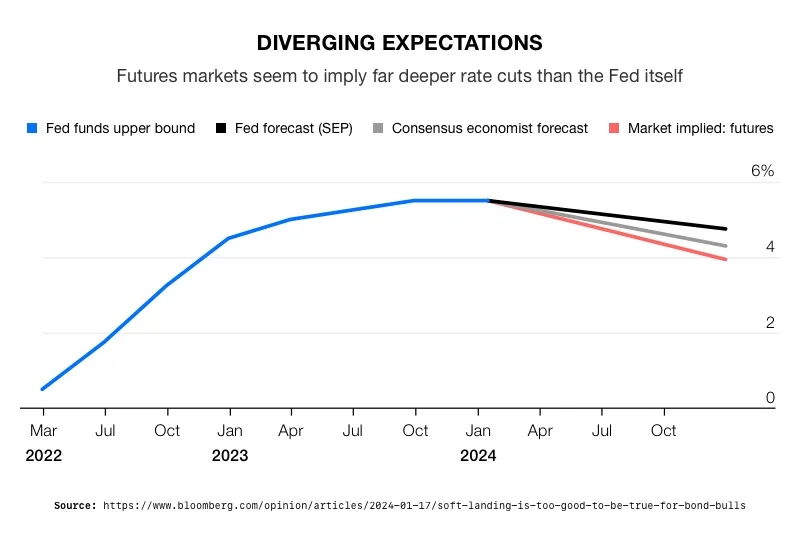

Futures markets are saying there’s an 80% chance there will be six or more rate cuts this year.2 Yet, they will be facing are very painful economic hangover if those cuts don’t materialize. “The stock market is going to have a much tougher time maintaining today’s high valuation levels,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Too many investors were equating the end of rate hikes and the beginning of rate cuts with a return to era of free money.”3

4

4

Now anxiety is growing over the impact of the bulls going too aggressively. Economic resilience and Fed officials are pushing back against the idea of reducing interest rates quickly. The Fed dot plot report points to a different picture than Wall Street’s. The dot plot provides a summary of individual policymakers’ expectations for future interest rates and economic conditions. The report indicates a median expectation for three rate cuts in 2024.

San Francisco Fed President Mary Daly said it’s “premature” to think rate reductions are around the corner. The Fed needs more evidence that inflation is on a track back to 2% before easing policy.

Impact of Rate Cuts

Maintaining this optimistic belief in an upcoming massive rate cutting cycle could cost investors dearly. The disconnect between what traders want and what is likely to happen is going to be rectified eventually, and not in a good way.

The anticipated 6 or 7 rate cuts are priced into today’s current high stock prices. There is little room left for stocks to climb any higher on additional rate cuts. If more than those anticipated rate cuts materialize, then that means the economy has taken a serious dive and the Fed is swooping in to do damage control.

There is ample downside if the cuts don’t materialize. In 2022, the market was desperate to believe a Fed pivot was about to happen. Even though Powell explicitly said rates were going to get more restrictive until inflation slows down. Stocks experienced a decline of over 20% when optimistic expectations about a dovish Federal Reserve stance were dashed.5

Historical Performance

In the nine previous times that the Fed paused interest rate hikes and then proceeded to cut them, stocks went up during the pause before the cut. However, once the cuts were enacted, stocks dropped. On average, following the start of interest rate cuts, the stock market experienced a 23% decline in value. For those with a $1 million stock portfolio, this could mean a worrying reduction to $750,000. 6

Conclusion

Wall Street looks like they are going to lose their “foolish” bet on interest rates. The Fed is in no hurry to cut rates with core inflation still running at 4% and no hard evidence of it trending to 2%. Rates are more than likely to stay higher for longer. That translates into falling bond prices, which spillover into lower stock prices. The market will be forced to reprice in higher rates at some point this year. This will almost certainly lead to a correction in stocks and bonds.

Analysts advise exercising caution and consider diversification strategies in anticipation of how rate cuts play out. Adding physical precious metals, especially within a Gold IRA, can provide a valuable hedge against potential stock market declines. Contact American Hartford Gold today at 800-462-0071 to learn more.