Treasury Secretary – Prices to Remain High

Treasury Secretary Janet Yellen testified before the Senate Banking Committee about inflation. Her outlook has come a long way from her initial proclamation that inflation was ‘transitory.’ Now she says prices are unlikely to return where they were before the inflation crisis began in 2021. This time it looks like she is right.

“I don’t expect the level of prices to go down. Some prices will be higher than they were before the pandemic, and will stay higher,” Yellen said.1

Fed Chair Powell agreed with her. “The prices of some things will decline. Others will go up. But we don’t expect to see a decline in the overall price level. That doesn’t tend to happen in economies, except in very negative circumstances,” Powell said.2

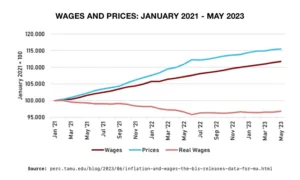

Yellen said that it’s ok because wages, for some people at least, have risen along with inflation. She continued, that because of rising wages, there is no need to get prices down. However, research shows real wages, which means wages adjusted for inflation, have fallen since January 2021. She went as far as to say, “So Americans, on average, are better off in spite of the fact that the level of prices is higher.”3

4

4

Negative Outlook

To say many Americans would disagree with her opinion is an understatement. A recent survey published by Bankrate shows that 50% of Americans say their financial situation has gotten worse since the 2020 presidential election. By comparison, just 21% think their financial situation has improved.5

The negative outlook is understandable as record inflation has sent prices on everything soaring. When compared with January 2021, shortly before the inflation crisis began, prices are up an astonishing 17.6%. Moody’s Analytics found Americans are paying on average $1,020 more each month compared with the same time two years ago.6

Contributing to the dismal outlook is the increasing price of housing. An increase largely due to the Fed’s rapid interest rate hikes. They raised interest rates 11 times since 2022 to cool the economy and lower inflation. The hikes caused the opposite effect on housing. According to the Bureau of Labor Statistics, shelter costs were up 6.2 percent year over year in December. Renters are now more cost-burdened than they ever have been, according to a report from Harvard’s Joint Center for Housing Studies. Adjusting for inflation, rent has grown 21 percent between 2001 and 2022. Renter income has grown only 2 percent in that time.7

The government is using select data to paint a broad picture of an economy on the mend. But it also disguises a grimmer view. ‘Rolling recessions’ are striking individual sectors of the economy. A Center for American Progress report showed that 43% of workers had wages that are the same or lower than they were before the pandemic. Decades of stagnant wage growth prior to the pandemic means much of the imbalance between costs and wages has been locked in. When you add in the meteoric rise in personal debt, the resumption of student loans, and tax increases, it looks like the government is forsaking a large portion of the population to preserve the reputation of ‘Bidenomics.’8

The ‘No Landing’ Scenario

Economists are touting the growing possibility of a ‘soft landing’. That inflation will come down without a recession. Though a sizable number still maintain that the country is going to experience a ‘hard landing’ – that a recession will occur, and, as a result, inflation will drop.

Based on Yellen’s statement, we may very well be facing a rare ‘no landing’ situation. Which means inflation would remain high, but productivity continues to increase. A ‘no landing’ would have serious consequences for retirement accounts.

Inflation Erosion: Warren Buffet said, “the arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislature.”9 High and persistent inflation erodes the purchasing power of money over time. This can affect the real value of retirement savings and reduce the standard of living for retirees as their money buys less.

Interest Rates and Fixed-Income Investments: As interest rates are kept higher for longer, fixed income investments may appear to provide better returns. However, the increase might not fully compensate for the eroding effects of inflation.

Equity Market Volatility: The equity market may experience volatility in response to uncertainty caused by continued inflation. While certain sectors may benefit from inflation, others may face challenges. Retirees with significant exposure to equities may experience fluctuations in the value of their portfolios.

Cost of Living Adjustments (COLAs): Social Security, pensions and certain retirement accounts often incorporate Cost of Living Adjustments (COLAs) to account for inflation. In a high and sustained inflation environment, these adjustments can open new tax liabilities.

Conclusion

The US economy could be entering a state of permanent inflation. Such conditions can introduce uncertainty into long-term financial planning. Retirees may find it challenging to estimate future expenses and income needs accurately. Those with retirement funds may need to carefully assess their portfolios. The time could be right to explore alternative investments that have historically served as hedges against inflation, such as precious metals in a Gold IRA. To learn more how a Gold IRA from American Hartford Gold can help you, contact us at 800-462-0071 today.