Gold Prices Continue to Rise

As prices continue to climb and hold strong at new heights, the future is gold. The price of gold has risen about 15 percent in the past year. Gold rallied to a high of $2,017 per ounce. Wall Street and retail investors are embracing the yellow metal in the face of a turbulent global economy. Goldman Sachs summed up the shared sentiment by saying the ‘shine is returning’ to gold.1

Gold prices rose to more than a six-month high. The increase occurred as the US dollar weakened and investors bet that the Fed is done with interest rate hikes. Growing geopolitical unrest, with wars in Ukraine and the Middle East, also boosted demand.

The prospect of a soft landing and avoiding a recession are not dampening gold’s appeal. Gold is a proven store of value. It is supply constrained. Miners produce on average just 2.5 per cent more per year. And it has no liquidity or counterparty risk.

Konstantinos Venetis is a commodities economist at GlobalData TS Lombard. He said: “A combination of three factors has pushed up the price of gold: central bank purchases (mainly in emerging markets); geopolitical turbulence; and, more recently, markets pricing in ‘peak’ interest rates and the rising likelihood of a softer USD.”2

Role of the Dollar

Gold’s price rise has been buoyed by the fall in the value of the dollar. It is hovering near a 3-month low. A weaker dollar makes buying gold cheaper for investors holding other currencies, boosting demand. This pushes its price higher due to increased buying.

Role of the Fed

In November, the Federal Reserve agreed to hold the federal funds rate at between 5.25% and 5.5% rather than raise it. This was because the consumer price index had come down to 3.7% in September. Some analysts have speculated that interest rates have now peaked.

The market thinks there is a 90% chance the Feds won’t raises interest rates again in December. The CME FedWatch Tool shows 25% probability of a cut as soon as March. This probability jumps up to a 50% chance in May.3

Lower interest rates tend to decrease the opportunity cost of holding non-yielding assets like gold. This reduced cost of holding gold increases its demand, subsequently driving its prices higher. Consequently, gold prices often surge in environments with lower interest rates due to increased investor interest.

Gold also tends to thrive when interest rates are lower as it’s less affected by the competition from higher-yielding safe-haven assets like treasury bills. The yellow metal becomes more appealing to investors seeking safe haven assets.

Role of Central Banks

Gold prices are receiving tremendous support from central bank purchasing. They are buying gold for several reasons. Central banks want a secure store of value amid global economic upheaval. They also want to protect their reserves from the kind of sanctions Russia suffered, in addition to joining the swelling dedollarization movement.

Over the first 9 months of 2023, central banks have bought 14 percent more gold than in the same period of the previous year. According to the World Gold Council, central banks bought a record 1,136 tons of gold in 2022. They added an additional 800 tons over the first three quarters of 2023. The People’s Bank of China was the single largest buyer, acquiring 181 tons.4

Globally, central banks hold almost 15 percent of their assets in gold. US dollars accounted for 58 percent of reserves at the end of 2022, according to the IMF. Even a small rebalancing could have big repercussions on the relatively tiny gold market.

Outlook

Analysts at Goldman Sachs said in a note about the metal’s outlook for 2024 that gold’s “shine in returning.”

“The potential upside in gold prices will be closely tied to U.S. real rates and dollar moves, but we also expect persistent strong consumer demand from China and India, alongside central bank buying to offset downward pressures from upside growth surprises and rate cut repricing,” Goldman said.5

Bank of America analysts, meanwhile, said that the commodities team’s base case was for gold to appreciate from the second quarter of 2024 as “real rates are pushed lower by the Fed cutting.”6

Fiona Cincotta is a senior market analyst at City Index. She said, “Should buyers achieve a close above $2009, the price could extend the bullish run towards $2050, the April high, before bringing $2082, the all-time high, into focus.”7

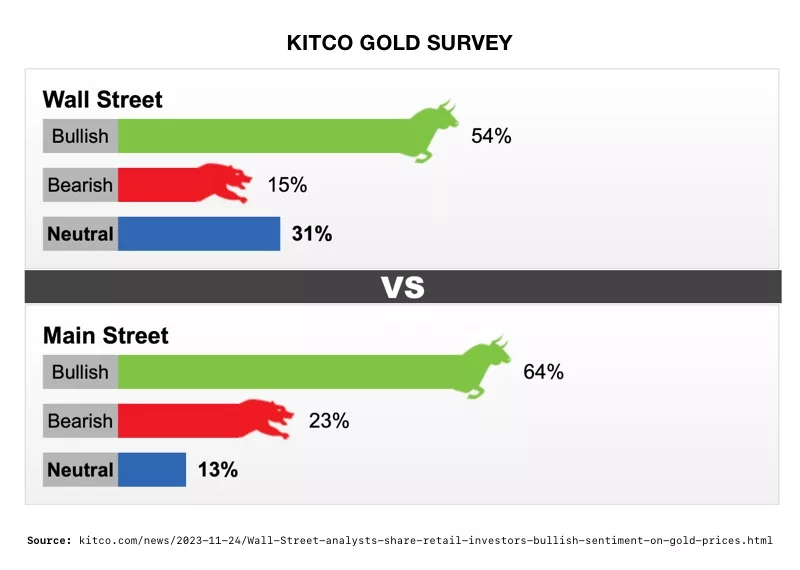

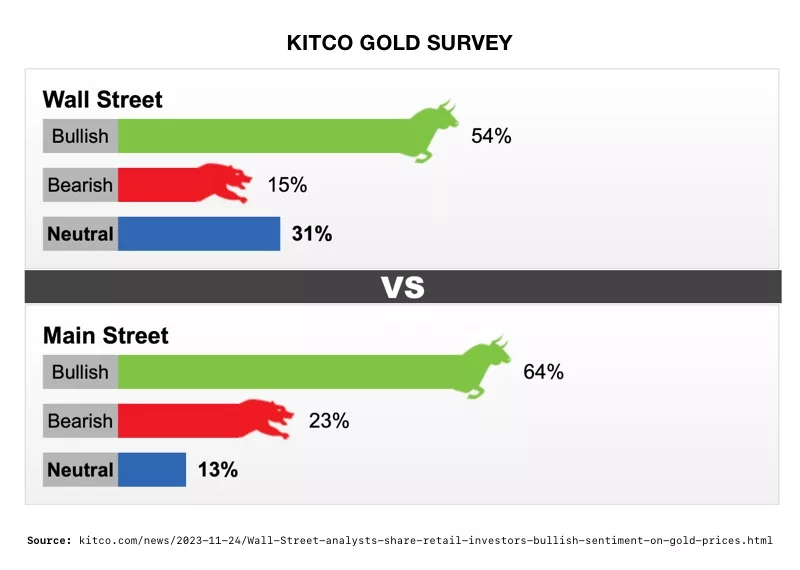

The Kitco News Weekly Gold survey showed Wall Street analysts share retail investor’s bullish outlook on gold prices. With some analysts predicting new all-time highs for 2024.

8

Conclusion

As global economic uncertainty increases, analysts agree – gold’s trajectory is on the upswing. Now is an opportune time to learn how physical precious metals can safeguard the value of your portfolio. A Gold IRA can not only protect your wealth, but potentially grow it. Contact us today at 800-462-0071 to learn more.

Notes:

1. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

2. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

3. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

4. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

5. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

6. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

7. https://www.kitco.com/news/2023-11-24/Gold-needs-to-break-above-2-010-for-prices-to-have-a-chance-at-ATHs.html

8. https://www.kitco.com/news/2023-11-24/Wall-Street-analysts-share-retail-investors-bullish-sentiment-on-gold-prices.html

8

Conclusion

As global economic uncertainty increases, analysts agree – gold’s trajectory is on the upswing. Now is an opportune time to learn how physical precious metals can safeguard the value of your portfolio. A Gold IRA can not only protect your wealth, but potentially grow it. Contact us today at 800-462-0071 to learn more.

Notes:

1. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

2. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

3. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

4. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

5. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

6. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

7. https://www.kitco.com/news/2023-11-24/Gold-needs-to-break-above-2-010-for-prices-to-have-a-chance-at-ATHs.html

8. https://www.kitco.com/news/2023-11-24/Wall-Street-analysts-share-retail-investors-bullish-sentiment-on-gold-prices.html

8

Conclusion

As global economic uncertainty increases, analysts agree – gold’s trajectory is on the upswing. Now is an opportune time to learn how physical precious metals can safeguard the value of your portfolio. A Gold IRA can not only protect your wealth, but potentially grow it. Contact us today at 800-462-0071 to learn more.

Notes:

1. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

2. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

3. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

4. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

5. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

6. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

7. https://www.kitco.com/news/2023-11-24/Gold-needs-to-break-above-2-010-for-prices-to-have-a-chance-at-ATHs.html

8. https://www.kitco.com/news/2023-11-24/Wall-Street-analysts-share-retail-investors-bullish-sentiment-on-gold-prices.html

8

Conclusion

As global economic uncertainty increases, analysts agree – gold’s trajectory is on the upswing. Now is an opportune time to learn how physical precious metals can safeguard the value of your portfolio. A Gold IRA can not only protect your wealth, but potentially grow it. Contact us today at 800-462-0071 to learn more.

Notes:

1. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

2. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

3. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

4. https://www.mining-technology.com/news/gold-price-hits-6-month-high/?cf-view

5. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

6. https://www.cnbc.com/2023/11/27/gold-at-six-month-high-as-dollar-declines-and-investors-eye-rate-cuts.html

7. https://www.kitco.com/news/2023-11-24/Gold-needs-to-break-above-2-010-for-prices-to-have-a-chance-at-ATHs.html

8. https://www.kitco.com/news/2023-11-24/Wall-Street-analysts-share-retail-investors-bullish-sentiment-on-gold-prices.html