- Massive 3rd quarter GDP growth caught economists off guard

- The growth occurred despite the Fed’s rate hikes meant to tame inflation

- Prominent Wall Street voices warn to prepare for an economic downturn

Warnings Amid Unexpected Growth

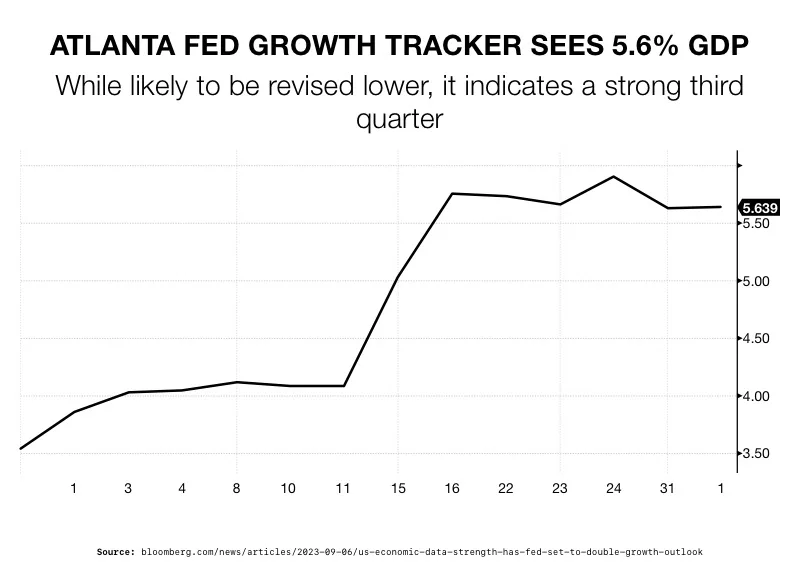

The economic landscape continues to surprise those in charge of mapping it out. In the third quarter, our Gross Domestic Product (GDP) showed surprising growth. It soared at an annual rate of over 5%. Such robust economic expansion contradicts expectations. It’s squashing the Federal Reserve’s desire for the economic slowdown needed combat rising inflation. Despite this sudden economic surge, Wall Street is weighing in with a pessimistic outlook on the future.1

2

2

Let’s unpack the surprising economic growth in the third quarter. The GDP figures far surpassed the predictions, raising eyebrows across the board. As far the Fed’s policy goals are concerned, this should not have happened.

Economists point to the government’s fiscal policy as the reason. The budget deficit doubled in the past year. It reached an astounding $2 trillion, according to the Congressional Budget Office. This sizable deficit, more than 7% of our GDP, contributed to the boost in economic growth. Such deficits are typically considered a result irresponsible fiscal management unless we are facing an extraordinary situation like a war.

About $500 billion of the $1 trillion added to the deficit served as an indirect stimulus. The other half a trillion dollars didn’t add to the economy. Instead, it was put toward things like bailing out collapsing banks.

Another factor boosting the GDP was an unanticipated easing the government’s monetary policy. The Treasury took actions that wound up countering the effects of the Fed’s interest rate hikes. The Treasury Department halted some debt issuances and borrowed from various savings accounts. This happened because the Fed reduced its bond purchases. The Treasury responded by issuing fewer bonds. As a result, it made more money available to people.

Now that the effects of the deficit and the shift in monetary policy have been felt, this boost in GDP unlikely to be repeated. A return to fiscal tightening is pointing towards a shrinking economy and a recession.

The coming downturn has the attention of some of the most powerful voices on Wall Street.

Wall Street Weighs In

Amid this economic chaos, several renowned figures in the financial world are offering their perspectives.

Jami Dimon is the CEO of JPMorgan Chase. As uncertainty grows, he warned about the dangers of locking in an outlook about the economy. He pointed to the poor track record of central bank predictions.

“I want to point out the central banks 18 months ago were 100% dead wrong,” Dimon said. “I would be quite cautious about what might happen next year.” He is referring to when the Fed insisted that the inflation surge was just transitory. Then it shot up to a 40-year high of 9.1%. Fed officials also projected their key interest rate rising to just 2.8% by the end of 2023. The rate is now almost double that at 5.25%.3

Dimon doubted “this omnipotent feeling that central banks and governments can manage through all this stuff.” He then warned that the Fed funds rate could eclipse 7%.4

Dimon recommends investors be prepared for fresh challenges in the new year. “This may be the most dangerous time the world has seen in decades,” he concluded.5

Ray Dalio is a legendary investor and founder of the world’s largest hedge fund, Bridgewater Associates. He is pessimistic about the global economy. He identifies geopolitical conflicts and the historic levels of government debt as key destabilizing factors.

David Solomon is the CEO of Goldman Sachs. He gauged the strength of the economy through mergers and acquisitions (M&A). He points out that the economic stimulus and low interest rates during the post-pandemic period led to a boom in M&A activities. However, capital has now become scarce, leading to a significant reduction in M&A deals. This is leaving Solomon uncertain about the current economic climate.

Larry Fink is the CEO of Blackrock. He predicted interest rates will rise further. The increase will ultimately be due to heightened conflicts around the world. Not only will interest rates rise, Fink says that unless the wars are resolved, it will lead to a “contraction in our economies.”6

Steve Schwarzman is the CEO of the Blackstone Group. He believes that it will take time to move past the pain of inflation and higher interest rates. He pointed out that recession struck after the Arab-Israel war in 1973. He said, ” We’re coming off the top and we’re starting to go down, so that would say to me that next year perhaps is not so wonderful.” Schwarzman pointed to the fragile commercial real estate market that is now facing up to 30% vacancy rates. “That’s going to have a very bad ending.”7

Conclusion

With a GDP bump soon to be in the rearview mirror, Wall Street experts are offering pessimistic takes on the financial future. As the economic landscape undergoes rapid shifts and uncertainties, it’s crucial to diversify your portfolio and explore options that can withstand the economic turbulence. One such option is to consider a Gold IRA from American Hartford Gold.

With a Gold IRA, you can secure your assets with physical gold, a proven hedge against uncertainty. In times of rising inflation and economic unpredictability, physical assets like gold can provide a valuable safety net. Contact us today at 800-462-0071 to learn more.