Debt & Deficit Continue to Skyrocket

The bill for America’s soaring national debt is coming due – with a staggering amount of interest! Over a trillion dollars in 2024 alone. Unfortunately, it appears unlikely that this debt will be paid off, leaving future generations to grapple with the fallout. Without immediate and decisive action, the consequences will be dire for anyone unprepared to face the financial crisis ahead.

Deficit vs Debt

The terms “national deficit” and “national debt” are often confused but represent different concepts. The national deficit refers to the shortfall between what the government spends and what it earns each year. When expenses exceed revenues, the government borrows to cover the difference, adding to the national debt. The national debt, on the other hand, is the total accumulation of deficits over time—the sum of what the government owes to its creditors.

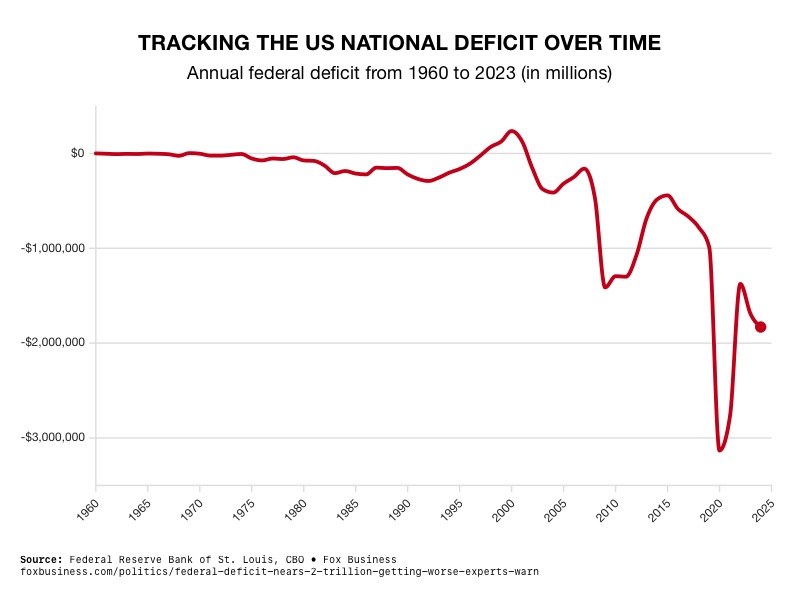

Exploding Deficits

For 2024, the U.S. government faces a deficit exceeding $1.8 trillion. That’s up more than 8% from last year – an eye-popping $138 billion increase. This marks the third highest deficit on record. It’s surpassed only by the extraordinary pandemic-related spending years. Despite record-high revenues of $4.9 trillion, government spending reached $6.75 trillion. A major contributor was the rising cost of interest on the national debt. It topped $1.16 trillion for the first time in 2024. Interest is now the third-largest outlay in the federal budget after Social Security and Medicare.1

2

2

As of 2024, the national debt stands at $35.7 trillion. An increase of $2.3 trillion from the end of the previous fiscal year. Along with interest, growing entitlement programs, like Social Security, are pushing the deficit beyond historical norms. For the past 50 years, the average deficit has been 3.7% of the U.S. economy. But the current figure is now more than double that, exceeding 6%.3

Looking ahead, the situation is likely to worsen. The Congressional Budget Office (CBO) projects that by 2034, annual deficits will swell to $2.8 trillion. The national debt will be pushed to 122% of the U.S. GDP from the current 100%. Experts warn that unless significant action is taken, the country risks fiscal instability. Maya MacGuineas is president of the Committee for a Responsible Federal Budget. She has voiced concerns about the lack of fiscal discipline. Saying, “We’re now borrowing $5 billion per day, while interest payments are soaring.”4

Despite these warnings, policymakers are not taking substantial steps to address the issue. The economic plans proposed by the leading presidential contenders have both been projected to widen the deficit further.

Michael Peterson is CEO of the nonpartisan Peter G. Peterson Foundation. He said, “The leaders we elect this fall will face a series of critical deadlines, including the return of the debt ceiling, the expiration of trillions in tax cuts, and automatic cuts in Social Security growing ever closer…unfortunately we have yet to see adequate plans from either of the presidential candidates.”5

From a National to International Problem

The debt problem is not confined to the U.S. Global public debt is projected to surpass $100 trillion by the end of the year. Governments around the world have been favoring short-term “borrow and spend” approaches rather than taking steps to control debt. The IMF warned that governments must lower debt to cope with economic shocks that “will surely come, and maybe sooner than we expect.” 6

Debt Consequences

If the national debt continues to grow unchecked, the U.S. could face serious economic consequences. In the worst-case scenario, the Federal Reserve may lose control over managing the economy. Government bonds would become unstable. And inflation would soar. Over time, the value of the U.S. dollar could drop. These developments would weaken the country’s global economic standing and diminish its leadership role.

Unchecked debt growth could also slow U.S. economic growth. The government would have fewer resources to invest in critical areas like infrastructure, education, and public research. Private investment could be crowded out as borrowing costs rise, stifling innovation and job creation. Experts also warn of potential job losses, reduced consumer spending, and diminished wages as businesses and households struggle under mounting financial pressure.

Conclusion

The record-breaking trillion-dollar interest payment is not just a figure on a balance sheet—it represents a warning sign. The U.S. must confront its growing fiscal imbalance, or risk spiraling into a cycle of slower growth, diminished innovation, and global economic decline. While the government passes the buck, there are actions Americans can take to protect their finances from the consequences of debt. Holding physical precious metals in a Gold IRA can protect the value of your funds. To learn more, contact us today at 800-462-0071.